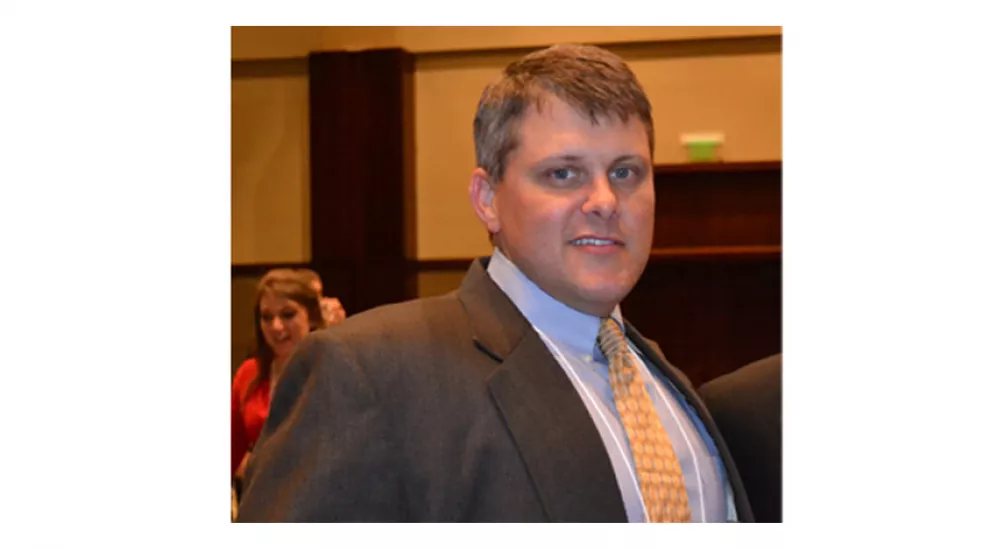

The Lexington Technology Center in Lexington, S.C. functions as a career and technology learning resource for all of Lexington School District One high school students. There students can learn real-world skills and receive training from Law Enforcement to Marketing. Randall Scott is a Finance teacher at the Technology Center. An FBLA advisor and proponent of financial responsibility, Scott teaches students the value of finance in students' personal lives as well as in the workplace. Mr. Scott shares his insights on economics and their importance in high school education with Carolina Money.

Q: Describe your finance class at the Lexington Technology Center.

A: The finance classes at LTC are separated into two distinct areas, finance for business and personal finance.

Accounting/Business Finance

If you are planning to major in accounting/business/finance in college, these courses will provide you with the foundation necessary to be successful.

Accounting helps students develop the skills necessary for the highly technical financial interaction between accounting and business. Students focus on accounting concepts, principles and practices. They also study procedures used in an accounting cycle as applied to several different kinds of business operations. Use of the computer in simulated activities gives students an opportunity to see the advantages of technology in accounting procedures.

Business Finance is designed to provide students with a foundation in corporate business finance concepts and applications including fundamentals, financial environment, management planning, maintenance and analysis of financial records, long and short-term financial activities, financial business activities, financial institutions and banking services, consumer credit, business insurance, technology and financial management, and international finance.

Personal Finance

Personal Finance is the one course that everyone should take before graduating high school. This course is designed to introduce the student to basic financial literacy skills which includes budgeting, obtaining credit, maintaining checking accounts, analyzing the basic elements of finance, computing payroll, recording business transactions, and applying computer operations to financial management.

Q: What is the value of these sorts of classes to high school students; why is it important for students to take these courses?

A: At LTC, we offer two promises! First, this will not be a boring finance class! Second, you will use the content covered in our finance classes every day for the rest of your life! Our finance teachers believe there are three main reasons [to take these courses]:

1. Money Management is a Learned Skill

Simply put, knowledge is power. Seventy-five percent of Americans live paycheck to paycheck. Why? No one is born understanding how to manage money. For many American families, financial lessons are learned by making mistakes that not only cause financial stress, but cause relational and psychological problems. Financial planning at the high school level can and will empower students with skills that they are not receiving anywhere else and will provide a financial security that many families never experience.

2. The Sooner Financial Education Starts, the Better

Finance is an 80/20 spilt. Eighty percent of finance is doing, the other twenty percent is knowing. Everyone knows that it is a good idea to start saving, but most are never really shown the importance of starting at a young age. Once habits are formed, they’re hard to break. Areas of finance including taxes, financing, and retirement investing can be hard lessons learned later in life, or empowering ones to students who are just starting out.

3. Finance Classes Provide Awareness of the Bigger Concepts

While many students learn math skills that allow them to calculate interest, deduct pay withholdings, and determine how much their check will be, there are still many financial concepts that are entirely foreign, even to some adults. Our finance classes are designed to teach students about concepts such as compound interest, investment risk, debt management, and goal setting. Think about the first house or vehicle a student will buy. A student who has learned about amortization will have a better understanding of the total cost when taking on a large purchase, and that helps them make better choices when faced with those decisions later in life.

Q: What are the most common financial issues students need the most help with or struggle with?

A: The Importance of an Emergency Fund

Let’s start with how much money should be placed in an emergency fund. Most experts agree that you should keep between three and six months’ worth of your living expenses in your emergency fund ($500 to $1000 if a student). This should be your first step to financial freedom. The struggle that most students have is threefold; first they could use that money to buy other things, second, up to this point in their lives, parents have taken care of all their financial situations, finally, emergencies will never happen to them. Why do over 70% of Americans live paycheck to paycheck? They never take the time to invest in the most important thing they have, themselves! Students should be taught that the last thing you want to do is to be forced to rely on credit cards or a loan when emergencies take place. Unfortunately society will teach you to turn to credit cards and building credit, which will do nothing but compound the problem that you faced in the first place.

Dangers of Credit

I can point to article after article about the financial stress that college students and adults face in our society. The simple fact is that we are in a financial crisis in the United States, not only on the personal level, but on the governmental level. Society teaches the use of credit. When you look at the actual numbers, why do many people pay several thousand dollars more for a vehicle that will lose most of its value in the first four years that you own it? I try to encourage students not to use credit except when buying a house. I understand that many of my students will not go through life without using credit, so I spend a lot of time explaining a “safe” use of credit. Three main steps: Establish an emergency fund, pay off (the full amount) your credit at the end of each month, any month you cannot pay out of your checking account, take the money out of the emergency fund and do not use the card again until your emergency fund is fully funded.

Importance of a Budget

Most students and adults have a negative attitude toward the concept of a budget. Most of my students see budgets as restrictive, constraining, and hindering. So how do we get to a place of financial stability? You have to have a plan. Businesses do not become successful by using guesswork and wasteful practices. Why do we then think that we can go through life without a financial plan and be successful? The worth of being frugal is a learned skill that has to be practiced. The problem that high school students face is that our society does not favor frugality. They are blitzed with ads about the latest technology and fashion on a daily basis. Why can’t I have what everyone else has? The answer is not that you are being restricted. The answer is that we will come up with a plan and not pay for that latest fad or gadget for the rest of our lives. Students need to practice, yes PRACTICE, living within their means and understand the difference between wants and needs, if you want to be financially stable. Learning how to make the most of what you have and how to get a good value on items that you do purchase will only yield financial benefits for your future.

Q: What are students most surprised to learn in your class?

A: The biggest question that teachers need to ask themselves on a regular basis is, “Why does this information matter to your students?” I think that everyone at one time or another has the vision of being financially successful. The problem that most students face is that financial issues are not taught at home or in school, they end up being learned through the hard knocks of life. In order to get students involved from day one with the importance of personal finance, I start with the powerful topic of time value of money. I know if someone had sat me down in high school and showed me this is what it takes to be a millionaire, I would be a lot closer to that goal at this point in my life. I want students to know and see that time is on your side! The relationship among time, money and rate of interest should be something that all students should be able to explain before they are allowed to graduate from high school. Using different tools and facts about the stock market, I show students just how easy it is to be a millionaire.

Q: How would you say your course relates to workforce readiness? As a teacher at the Lexington Technology Center and an FBLA advisor, how would you define workforce readiness?

A: I feel that workforce readiness is directly related to several different soft skills that students should have in order to be effective employees: communication, passion/attitude, ability to network, problem solving/critical thinking, and teamwork. All of these skills are emphasized in any class I teach. The benefit to having personal finance and readiness skills is that you are not only socially ready for the workforce, but a lot of the financial strain is removed, allowing you to breathe.

Q: What is some advice you would offer students entering college? Some advice for college students entering the workforce?

A:

- Avoid Debt: If you are not tied to payments, you can do just about anything you want.

- Continuously Learn: Never stop learning. If you are in school, that is a good beginning. Don’t stop there! Read! Thirst for knowledge!

- Network: You never know who will give you the opportunity at an awesome career. Most jobs will be given to an acquaintance of an acquaintance.